Bookkeeping

Bookkeep: Shopify Accounting Automation Software Integration

That’s why most Shopify sellers use accounting integrations like Link My Books or work with e-commerce specialist accountants such as ecommerceaccountants.co.uk. As a business owner or Shopify accountant, Bench.co allows you to focus on running your business while it handles your bookkeeping. It is highly customizable and allows you to customize its interface to suit your business style or personality. Also, you get features like cash flow forecasts, inventory monitoring, and auditing, alongside other important features like project costing, budgeting, expenses tracking, and automated workflows.

- This will help you identify any problems or areas where you can improve.

- OneUp is an accounting app that assists in calculating the sales tax, so you know what exactly to pay.

- FreshBooks also works perfectly for small businesses, mainly because of its affordable pricing.

- You can manage it all from your smartphone or tablet thanks to its high-quality mobile app.

When it comes to reconciliation, in this case, it refers to transferring the balance from the end-of-the-month bank statement or credit card statement to QuickBooks. The purpose of this step is to ensure that all transactions have been recorded into QuickBooks and that none are duplicated or missed. In the second step, reconcile bank and credit card statements with QuickBooks. The process of reconciling bank feeds is commonly known as reconciliation among QuickBooks users.

Shopify Bookkeeping, Why Is It Important for Your Business?

Currently, Steve is a Senior Merchant Success Manager at Shopify, where he helps brands to identify, navigate and accelerate growth online and in-store. Today, finding a competent and qualified bookkeeper at a reasonable price is tricky. We want to discuss the benefits of hiring a bookkeeping assistant and why they are the best choice for startups.

Does Shopify allow inventory management?

Does Shopify Have Inventory Management? Yes, Shopify does have some built-in tools for managing inventory in your stores. These include tracking, purchase order creation, bulk editing, and the option to add tags to products.

Add your team members, bookkeeper, accountant, or tax professional as needed. From there, you can take care of payments, accounts, and inventory with confidence. Now that you know all the pros and cons of cloud-based accounting software, how in the world can you pick one provider out of the dozens in the market? We’ve put together an extensive checklist of considerations to consider when comparing the different solutions available to you. One of the most popular options is SkuVault, which offers a comprehensive suite of features for managing inventory, including barcode scanning, real-time stock levels, order tracking, and more.

Modern CRM And Ecommerce – Pairing The Powers

As a new Shopify business owner, you can easily design your interface using its customizable templates. Another cool feature of this software is that it sorts and manages your bills. So, you can pay on time, and every time, by tracking due dates and making direct payments. According to user reviews, it’s straightforward to use even without prior bookkeeping or accounting knowledge. You also get customizable sales tax, dashboard monitoring, transaction management, and exportable accounting reports. Effective accounting for Shopify enables store owners to precisely monitor their sales, expenses, and profitability.

Your books aren’t there merely to help you claim back tax, tick legal boxes, or make the IRS happy. Sales tax is a huge topic that heavily depends on what you sell, where and how. For this reason, we have dedicated guides to help you better understand everything below. In the next part of our Shopify accounting hub series, we explore the industry leaders on the market and how their offering suits Shopify sellers in particular. We focus on

QuickBooks,

Xero, and

Sage, and break down why they’re great and how to make them even better.

Importance of Bookkeeping for Shopify E-commerce Store

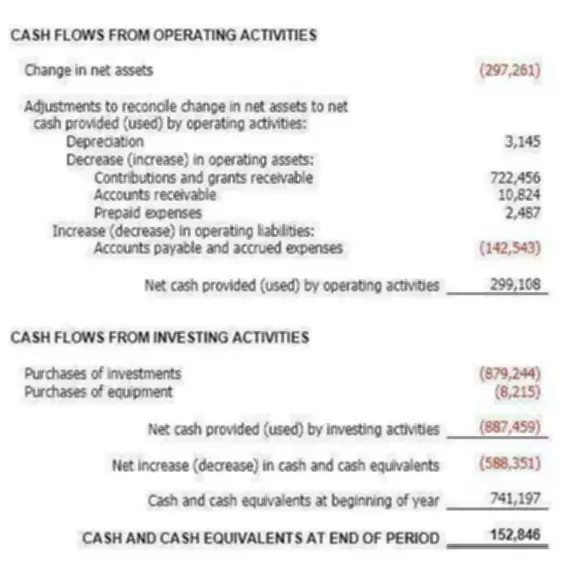

Utilize the reporting features of your accounting software to access essential reports like profit and loss statements, balance sheets, and cash flow statements. In Bookkeeping, you are recording and tracking all of your financial transactions. Depending on the method you choose, you can either use a spreadsheet, one of the methods in step one, or cloud accounting software. To become a better bookkeeper, you have to select a system that suits your needs. With cloud software, you can save a lot of time and ensure that your finances are up-to-date and accurate.

- This includes categorizing expenses, applying tax codes, and classifying income sources.

- Whether you have a Shopify or ShopifyPlus store selling within the UK, Europe, or the USA, Sterlinx has you covered.

- Furthermore, your clients can make bulk payments and share their recent transactions with your account.

- The good news is that Link My Books works for all payment gateways through one single connection to your Shopify account.

With Avalara, you can be confident that all of your taxes are being taken care of properly. We use these clearing accounts to record the funds that are expected from each third-party payment gateway, which have yet to be deposited into your bank account. For sales paid for via Shopify Payments, Link My Books generates one settlement summary report for each payout you received from Shopify. how to calculate loan payments with excel pmt function This means that the invoices you send to Xero or QuickBooks from Link My Books will match exactly the amount Shopify deposited into your bank account. So these are nice and easy to reconcile directly on your bank reconciliation page in Xero or QuickBooks. It also handles all other payment gateways if you’re making sales via PayPal, Klarna, etc. or via Shopify POS for example.

How to reconcile payments into the bank from Shopify & other payment gateways

In other words, your sales minus and costs that are directly incurred as part of those sales. You could also download one of your monthly bills which would show clearly if any VAT has been charged. So when VAT is reverse charged it essentially means that the supplier does not charge any VAT, the customer does not pay any VAT but both parties account for it. If you’re selling any products that are zero rated or reduced rated then those will also need to be separated out.

Does Shopify do QuickBooks?

Description. QuickBooks for Shopify allows you to seamlessly export all of your Shopify sales to QuickBooks, directly from your admin.

Does Shopify have its own accounting software?

PRO TIP: While Shopify is a popular ecommerce platform, it is important to note that they do not have their own accounting software. This means that if you are using Shopify to run your business, you will need to find and use your own accounting software.